The Center for Retirement Research at Boston College recently reported on the following:

About half of the nation’s private-sector employees do not have a retirement savings plan at work, and that hasn’t changed in at least 40 years.

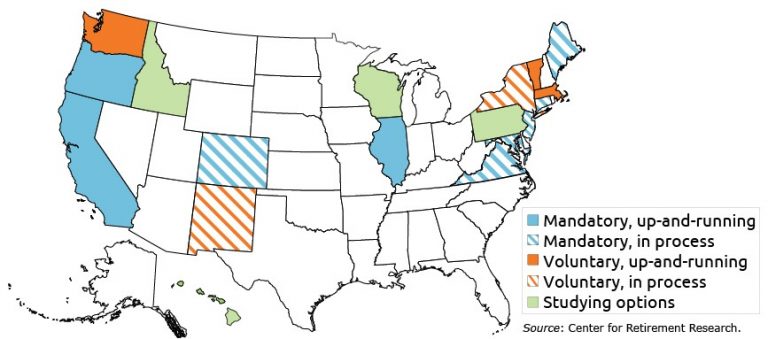

Some states are trying to fix this coverage gap in the absence of substantial progress by the federal government in solving the problem. And the state reforms are gaining momentum.

These mandatory programs are the only practical way to close the coverage gap, because voluntary retirement saving initiatives have never done the trick. Numerous voluntary plans created by the federal government – such as the Simplified Employee Pension (SEP) – have failed to measurably increase coverage.

State auto-IRA programs eliminate the administrative burden and expense to employers of a private plan and provide an easy way for workers to save. The money is taken out of their paychecks before they can spend it and is deposited in an account that grows over time. The state programs also permit workers to withdraw their contributions without a tax penalty for emergencies, like a medical problem or broken-down car, if they need the money they’ve saved.