What is Elder Financial Exploitation?

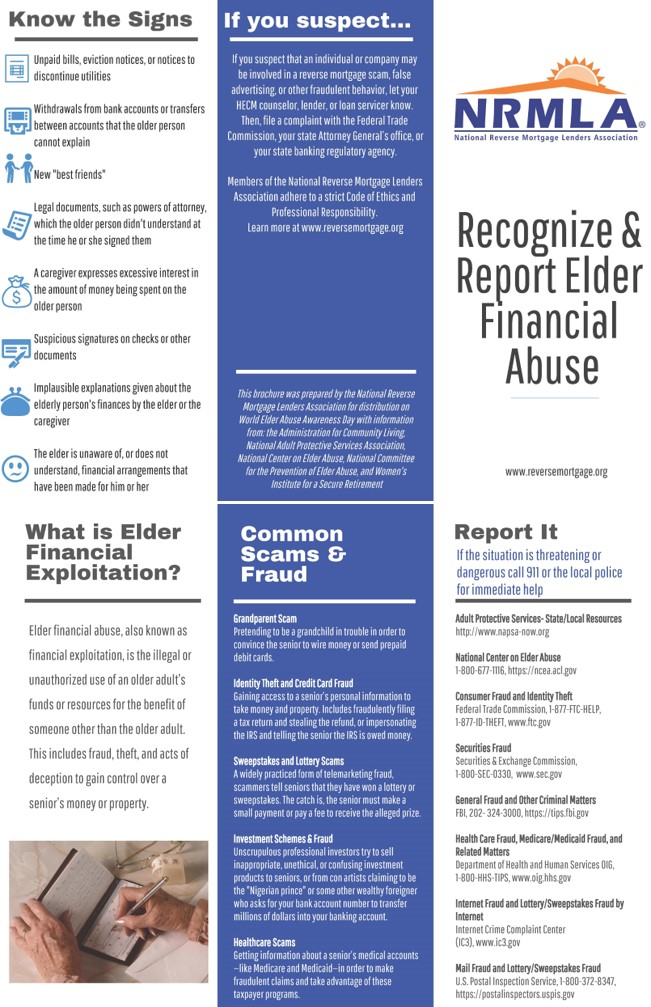

Elder financial abuse, also known as financial exploitation, is the illegal or unauthorized use of an older adult’s funds or resources for the benefit of someone other than the older adult. This includes fraud, theft, and acts of deception to gain control over a senior’s money or property.

- Common Types of Senior Financial Abuse

- Report Senior Financial Abuse – Resources & Directory

Know the Signs:

Some of the indicators of financial exploitation listed below can be explained by other causes or factors and no single indicator can be taken as conclusive proof. Rather, one should look for patterns or clusters of indicators that suggest a problem.

- Unpaid bills, eviction notices, or notices to discontinue utilities

- Withdrawals from bank accounts or transfers between accounts that the older person cannot explain

- Bank statements and canceled checks no longer come to the elder’s home

- New “best friends”

- Legal documents, such as powers of attorney, which the older person didn’t understand at the time he or she signed them

- Unusual activity in the older person’s bank accounts including large, unexplained withdrawals, frequent transfers between accounts, or ATM withdrawals

- The care of the elder is not commensurate with the size of his/her estate

- A caregiver expresses excessive interest in the amount of money being spent on the older person

- Belongings or property are missing

- Suspicious signatures on checks or other documents

- Absence of documentation about financial arrangements

- Implausible explanations given about the elderly person’s finances by the elder or the caregiver

- The elder is unaware of or does not understand financial arrangements that have been made for him or her

(Learn more from the National Committee for the Prevention of Elder Abuse)

What if you just have a “feeling” about a situation but can’t verify the details?

Adult Protective Services workers are professional social workers trained to handle just such a situation. Based on your report, the agency will assess the situation and determine how best to respond. Since laws and regulations vary widely across the United States, only your local APS agency can determine the best course of action in any given situation.

Common Types of Senior Financial Abuse

Telemarketing and Internet Fraud

Targeting victims through the mail, phone, or email—characterized by aggressive tactics along with the use of false promises of cash prizes, goods, or services in exchange for paying fees or making purchases.

Identity Theft and Credit Card Fraud

Gaining access to a senior’s personal information to take money and property. Includes tax ID theft where a scammer uses a senior’s Social Security number to file a tax return and steal the refund, or impersonates the IRS and tells the senior that the IRS is owed money.

Grandparent Scam

Pretending to be a grandchild in trouble in order to convince the senior to wire money or send prepaid debit cards.

Sweepstakes and Lottery Scams

A widely practiced form of telemarketing fraud, scammers tell seniors that they have won a lottery or sweepstakes. The catch is, the senior must make a small payment or pay a fee to receive the alleged prize. Seniors may also receive a fake check back from the scammer, which will “bounce” after it gets deposited.

Investment Schemes & Fraud

Unscrupulous professional investors try to sell inappropriate, unethical, or confusing investment products to seniors, or from con artists claiming to be the “Nigerian prince” or some other wealthy foreigner who asks for your bank account number to transfer millions of dollars into your banking account.

Healthcare Scams

Getting information about a senior’s medical accounts —like Medicare and Medicaid—in order to make fraudulent claims and take advantage of these taxpayer programs.

(This information is adapted from the Women’s Institute for a Secure Retirement and the National Adult Protective Services Association)

The National Reverse Mortgage Lenders Association and the National Aging in Place Council are partnering together to raise awareness about elder abuse and exploitation. Visit www.ageinplace.org and

www.nrmlaonline.org for more resources.

If you, or someone you know, is a victim of fraud, abuse or exploitation report it.

If the situation is threatening or dangerous call 911 or the local police for immediate help.

If you suspect that an individual or company may be involved in a reverse mortgage scam, false advertising, or other fraudulent behavior, let your HECM counselor, lender, or loan servicer know. Then, file a complaint with the Federal Trade Commission, your state Attorney General’s office, or your state banking regulatory agency.

National Center on Elder Abuse

800-677-1116

State by State directory of reporting numbers, government agencies, state laws, state-specific data and statistics, and other resources

https://comparite.ch/elderfraudbystate

Consumer Fraud and Identity Theft

Contact the Federal Trade Commission at 1-877-FTC-HELP, 1-877-ID-THEFT, or online at www.ftc.gov.

US Senate Special Committee on Aging

To report scams, receive information on how to avoid/recover from scams or get referrals for other agencies, including the Better Business Bureau, you can contact the Committee’s toll-free Fraud Hotline at 1-855-303-9470.

General Fraud and Other Criminal Matters

Contact the FBI at (202) 324-3000, or online at www.fbi.gov or https://tips.fbi.gov.

Health Care Fraud, Medicare/Medicaid Fraud, and Related Matters

Contact the Department of Health and Human Services, Office of the Inspector General at 1-800-HHS-TIPS, or online at www.oig.hhs.gov.

Internet Fraud and Lottery/Sweepstakes Fraud by Internet

Contact the Internet Crime Complaint Center (IC3) online at www.ic3.gov.

Mail Fraud and Lottery/Sweepstakes Fraud

Contact the U.S. Postal Inspection Service at 1-800-372-8347, or online at https://postalinspectors.uspis.gov.

Securities Fraud

Contact the Securities and Exchange Commission at 1-800-SEC-0330, by email at enforcement@sec.gov (link sends e-mail), or online at www.sec.gov.