For many, retirement can feel a bit like a fairy tale. When you’re young and working, it might seem like slow-building retirement savings (if you have any) might not ever materialize into anything substantial. People have different retirement goals and priorities, and many wonder how much they’ll need to save to make their retirement dreams come true.

Recent studies have shown that some younger Americans have improved access to and higher participation in retirement plans than previous generations. One study also concluded that millennials had higher balances in their 401(k)s than Gen Xers did at the same age.

To further explore the idea of retirement in the U.S., both broadly and broken down by generation, ConsumerAffairs asked where people stand when it comes to saving for their dream retirement.

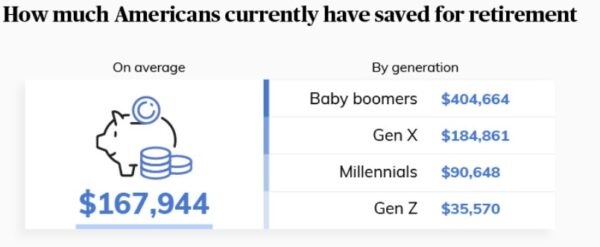

The survey found, for example, that the average amount saved for retirement across all age groups was $167,944, while Baby Boomers had the highest amount saved at $404,664. Other key takeaways:

- 71% of Americans said they will rely on savings outside of their employer-provided retirement plan, while 64% will rely on their work retirement plan;

- Only 9% of Americans said they are not actively saving for retirement;

- 22% of Americans said they will rely on cryptocurrency investments for retirement;

- 66% of survey takers who fall within the Gen Z age group want to retire before the age of 60, and 56% believe they’re on track to do so; and

- Only 14% of retirees believe they’ve achieved their dream retirement situation, while 26% remain very worried about money.