Eighty percent of U.S. households with older adults, or roughly 47 million households, are financially struggling today or are at risk of falling into economic insecurity as they age – although home equity is one option they can explore to overcome these challenges – according to researchers at the National Council on Aging and LeadingAge LTSS Center @UMass Boston.

One of the most significant costs burdening older adults is long-term care services and supports (LTSS), ranging from non-medical assistance with activities of daily living to medical care in a skilled nursing facility. While many Americans underestimate the need for LTSS, over half of adults 65 and older will need LTSS for less than two years, and about one in seven will require care for more than five years.

Analyzing the latest data from the Health and Retirement Study, a well-respected and nationally representative panel study of middle-aged and older adults, researchers found that 60 percent of older adults would be unable to afford two years of LTSS. Additionally, 45 percent of people 60 and older had household incomes below the Elder Index value for their geography. In other words, their average income was below what they needed to afford basic living needs.

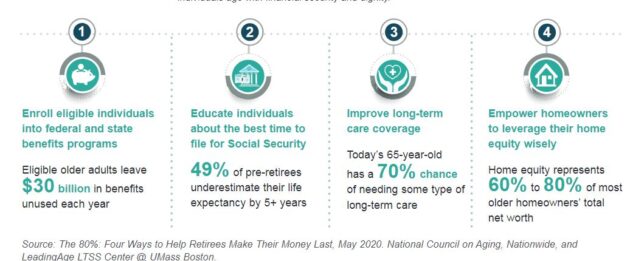

Potential solutions include optimizing Social Security, accessing benefits, improving long-term care, and using home equity to maximize savings to deal with price shocks. Read the full report.