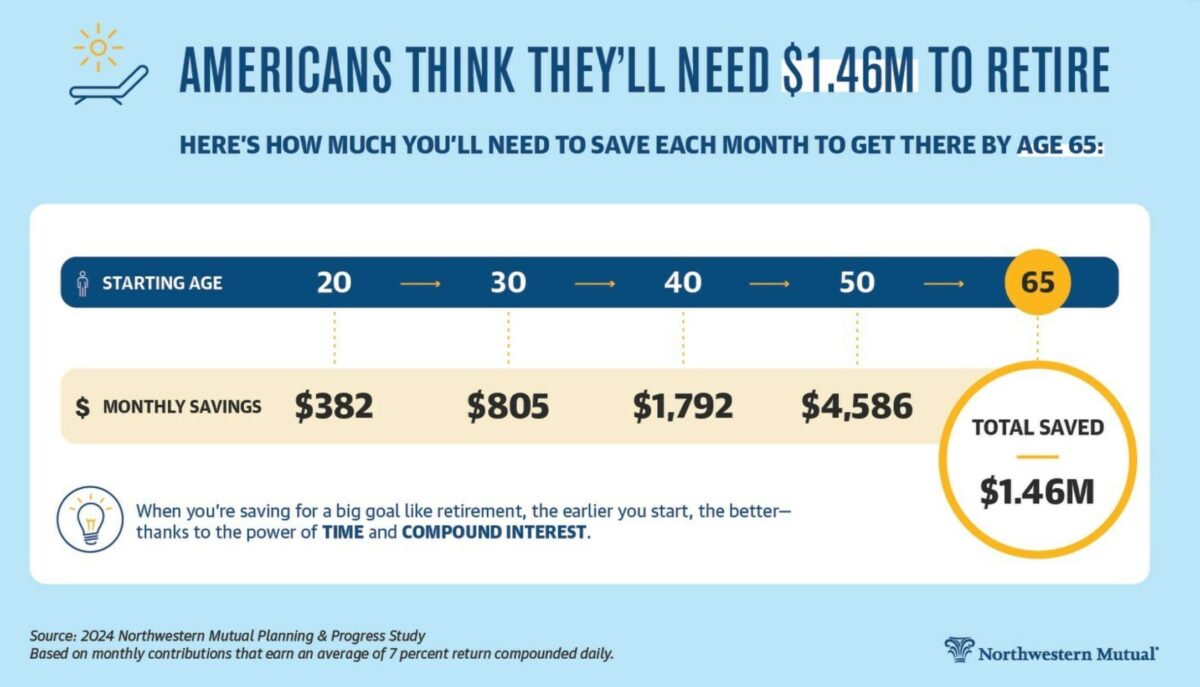

Americans’ “magic number” for retirement surged to an all-time high – rising much faster than the rate of inflation while swelling more than 50% since the onset of the pandemic.

These are the latest findings from Northwestern Mutual’s 2024 Planning & Progress Study, the company’s proprietary research series that explores Americans’ attitudes, behaviors, and perspectives across a broad set of issues impacting their long-term financial security.

By the numbers: By generation, both Gen Z and Millennials expect to need more than $1.6 million to retire comfortably. High-net-worth individuals – people with more than $1 million in investable assets – say they’ll need nearly $4 million.

- Meanwhile, the average amount that U.S. adults have saved for retirement dropped modestly from $89,300 in 2023 to $88,400 today but is more than $10,000 off its five-year peak of $98,800 in 2021.