All too frequently we tend to read or hear misinformation about reverse mortgages doled out, sometimes in the press, sometimes by consumer groups or politicians. When wrong information appears in the press, we also find that it is often repeated in future press articles. We attribute this to the fact that a reverse mortgage is a unique product that needs to be studied—and those who misinform often do not take the time to properly study or research it.

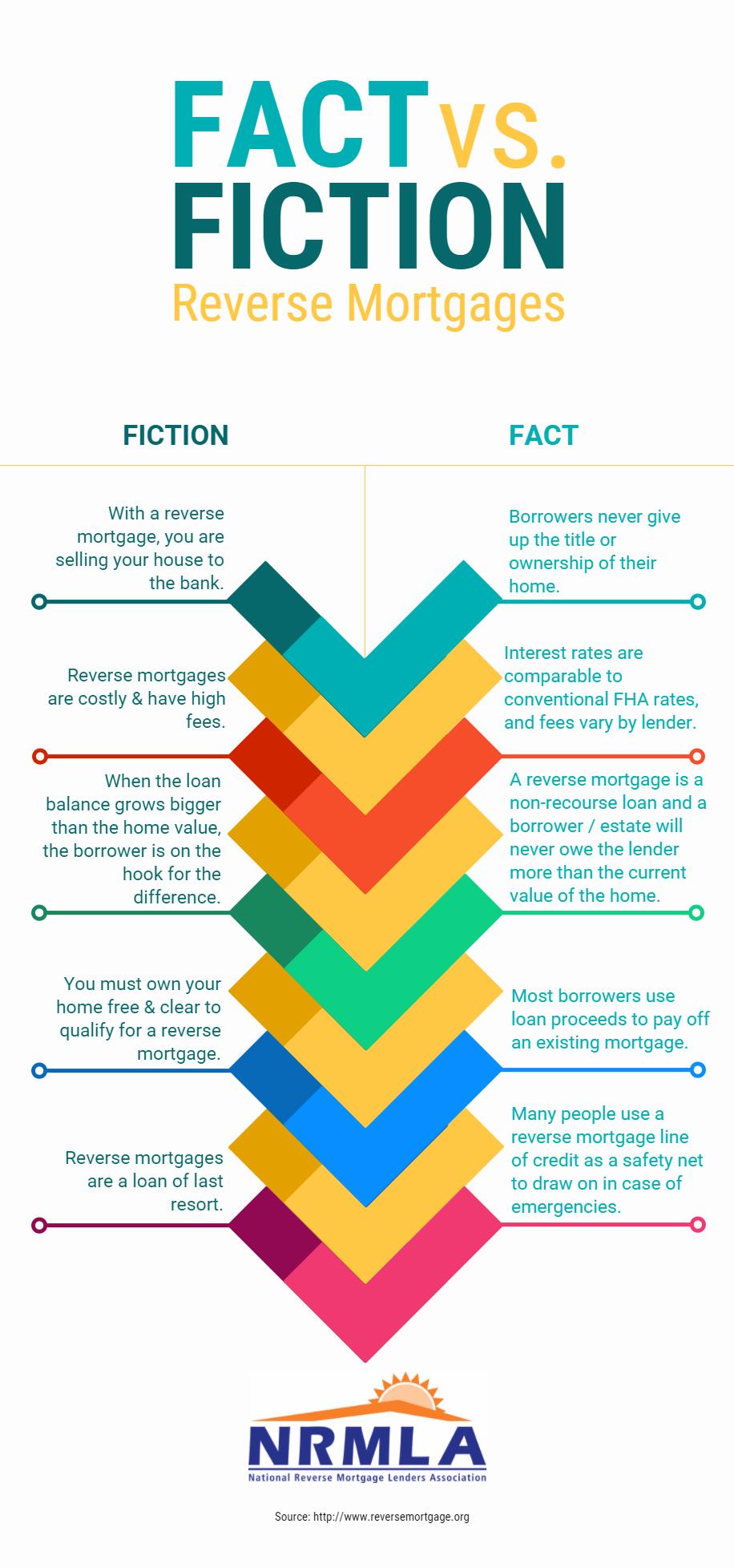

The most commonly heard misinformation is:

Reverse mortgages are some kind of scam

A reverse mortgage is a well thought out, very creative and highly effective solution to a societal problem—the inability of some seniors to have enough money to get through their retirement years. With people living longer than they might have anticipated and with many people’s savings diminished by the economic downturn, being able to use your home equity is one of the sources of support and comfort available.

Reverse mortgages are too good to be true

Reverse mortgages are not a fantasy. They are by no means a trick. You worked hard to earn the equity in your home and you deserve the chance to use that money if and when you need it. There is a cost attached to a reverse mortgage, as with every loan. And there are responsibilities that come with it.

Reverse mortgages are the loan of last resort

In some people’s cases they may be. For others they may not be. You may choose to use a reverse mortgage to help you cover your expenses while you wait for your retirement savings account to go back to their prerecession levels. You may use it to help you through until home values recover and you can sell your home for a higher price. A reverse mortgage, like Social Security, Medicare/Medicaid, IRAs and 401(k)s, is an option in a retirement toolbox—and different situations require different tools.

When you take a reverse mortgage, the bank owns your home

No, you continue to own your home. And when you pass on, your heirs own your home, though they must then pay back the reverse mortgage. If you are in arrears on taxes and insurance, you are in default and, to keep your home, you must work with the lender to catch up on your obligations.

Salesman insist a senior use the loan proceeds to purchase another financial product as a condition for obtaining a reverse mortgage

No, this is not legal.

Reverse mortgage lenders aggressively push seniors to take the proceeds in a lump sum so they can earn interest on a high loan balance

By law, a loan originator must present all options that are available to you.

Counselors are in cahoots with the Lenders and only there to make sure you take out a reverse mortgage

Untrue. Counselors must be independent and are tested and certified by HUD. A counselor’s responsibility is to the borrower, not the lender.

Reverse mortgages are expensive

Reverse mortgage fees are similar to those for any other mortgage product. The one additional fee is the Mortgage Insurance Premium, which is paid to the government mortgage insurance fund to protect you in the event the loan balance grows larger than the value of your home.

Advertising is misleading

Historically, there has occasionally been misleading advertising: ads that tout reverse mortgages as a “government sponsored program,” which they are not. Ads that contain an artificial check. Ads that falsely promise you payments for life, when you need to pay your taxes and insurance. But the Federal Trade Commission, the Federal Housing Administration and the Consumer Financial Protection Bureau have all passed regulations forbidding specific misleading language and presentation. NRMLA also specifies advertising restrictions in its Code of Ethics and Professional Responsibility. Companies that run misleading ads are subject to various forms of punishment. If you see or receive a misleading or false ad, please report it to us.