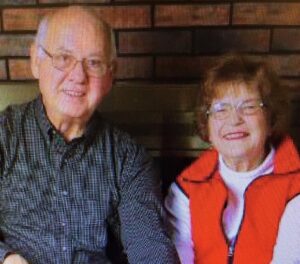

Bill Batdorf and his wife Elaine, who are both in their late 70s, live in a lovely home on the shores of Apple Valley Lake, near the town of Howard, OH. The nearest city, Columbus, is about an hour away.

“We just celebrated our 50th anniversary last year,” says Bill. “It’s a long story, but we met after a friend told me I should call her.”

They both had successful professional careers—Bill was an engineer for 35 years and Elaine was a high school teacher—but the costs of maintaining their home had become a challenge. When he was 59, Bill’s employer—a company that made large engines and compressors for the oil and gas industry—downsized, and Bill was let go. Worse still, Bill was informed by management that he would not be getting a pension.

“It was a discouraging situation to be out of work at that age and without a pension,” says Bill. There were no engineering jobs close by, so for the next couple years he started an antiques business and was a college shuttle driver, both fun jobs but they did not provide sufficient income.

The Batdorfs considered downsizing, but Elaine was against it. She loved interior decorating and had spent 25 years sprucing up every square inch of their home. Bill enjoyed antiquing and had furnished the place with items he had spotted while operating his antiques business.

“We owned this house outright and desperately didn’t want to give it up,” says Bill.

Bill was talking with his insurance agent one day and by chance asked him whether he knew anybody who offered reverse mortgages. The insurance agent referred him to Mark Kelly, a reverse mortgage loan officer at Mutual of Omaha Mortgage, who lived nearby.

Bill had gathered information on reverse mortgages on the internet and had identified several lenders, but “I ended up calling Mark and he offered to come out to our place and meet with us,” says Bill. “He must have been here for about two hours. He didn’t try to sell us but explained how the program works and why in our particular situation it made sense. As we got to know him, we learned that he and Elaine both attended Mount Union University.”

After meeting with Kelly, the Batdorfs took the next step and met with an independent HUD-approved housing counselor. They selected a counselor based in nearby Columbus who met with them for over an hour. The counselor provided unbiased information about reverse mortgages, discussed alternative options and answered their questions.

“It was pretty convincing that a reverse mortgage was our best option,” says Bill. The Batdorfs closed on their reverse mortgage in 2017 and used the proceeds to pay for daily living expenses that enabled them to continue living in their lakefront home.

Prior to getting a reverse mortgage, the Batdorfs were living off Social Security and stock investments. The Batdorfs met with a retirement planner, who analyzed the couple’s retirement assets and recommended the right annuity that could provide a large enough income stream to pay their property taxes.

Between the reverse mortgage and the annuity, the Batdorf’s financial situation has greatly improved. They refinanced their reverse mortgage in December 2020 to take advantage of historically low interest rates and increasing property values. This enabled them to access additional equity while saving money over time because their loan balance would grow at a slower rate.

While he doesn’t talk openly about his finances with other family members or friends, Bill was adamant that he would recommend a reverse mortgage to anyone who was going through a similar situation as he and Elaine.

“If I had a neighbor who was going through a similar situation and was willing to talk about it, you bet I would recommend that they consider a reverse mortgage,” says Bill.

The best part of this story is that Bill and Elaine can continue enjoying the picturesque lake that they’ve lived along for the past 25 years. “We have been boaters through the years,” says Bill. “We still have a hurricane deck boat and always enjoy it when the kids and grandkids can come to visit.”