MarketWatch interviewed several financial planners to find out what they’re recommending to their clients to lessen the impact of increasing inflation.

The general consensus is that consumers should develop a comprehensive plan that includes bolstering savings and tapping home equity, or delaying retirement, Social Security benefits, and big expenses.

“HECMs offer retirees who own their homes the ability to tap into home equity if they need it,” says Jason Branning, a certified financial planner with Branning Wealth Management in Ridgeland, MS. “By installing a HECM expanding line of credit, the non-recourse loan line grows over time. Higher interest rates will increase the line of credit more rapidly than when rates are low or stagnant.”

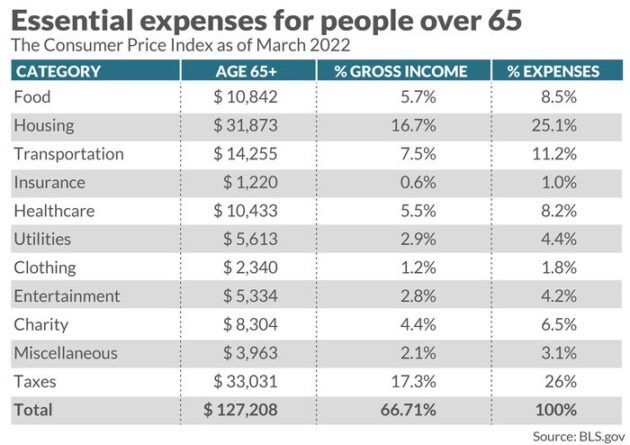

Banning further noted that the headline inflation rate reflected in the consumer price index is good to know, but what’s really important to understand is your personal rate of inflation. “One thing retirees should consider is that their personal inflation can differ from headline CPI,” he says. “Each retiree has their own personal annual inflation factor that may materially differ from the calculated CPI.” Read the full article.

In the age of inflation, there are steps you can take to deal with higher prices