U.S. households increased their total debt by $271 billion during Q4 2023 – roughly 19% more than the average for Q4 over the past 20 years. As a more… Yikes, Household Debt Spikes

Yikes, Household Debt Spikes

U.S. households increased their total debt by $271 billion during Q4 2023 – roughly 19% more than the average for Q4 over the past 20 years. As a more… Yikes, Household Debt Spikes

ForbesHealth has compiled statistics and facts that further demonstrate a strong desire among older homeowners to age in place in their current homes but also underscores the need more… Aging In Place Statistics (2024)

The Retirement Security Project at The Brookings Institution convened an event recently that traced the evolution of retirement policy in recent decades and discussed the many ways to more… Brookings Institution Examines Evolution of Retirement Policy

The Employee Benefits Research Institute estimates that couples with high Medicare prescription drug expenditures will need $413,000 to have a 90 percent chance of having enough money to more… New Forecast: Couples May Need $413K For Future Healthcare

A 65-year-old retiree living in California can expect $1 million in savings to last under 14 years, while that amount will last almost 21 years in Texas. By more… How Long Will $1 Million In Retirement Savings Last In Your State?

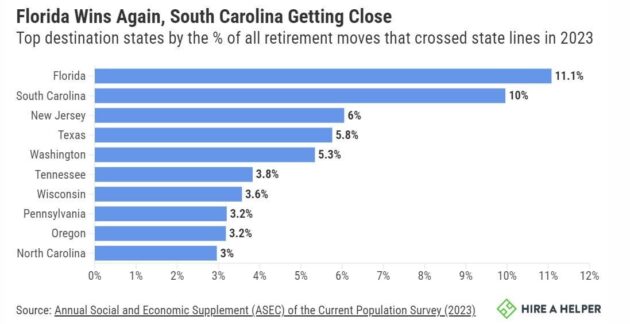

More than 338,000 Americans moved to another state to retire in 2023, according to Census Bureau data analyzed by the online moving resource, Hire a Helper. Why it more… Seniors Flocked to These States in 2023

A recent article in Kiplinger’s Personal Finance offers advice for retirees who are thinking about selling their home and either downsizing or upsizing to a property that better more… For Boomers Who Can’t Downsize, a Reverse Mortgage Can Help

A new report by The Pew Charitable Trusts revealed that state-sponsored retirement savings programs have collectively reached over $1 billion in assets as of November. Why it matters: more… State-Sponsored Retirement Savings Programs Reach $1 Billion in Assets

Taxes on Social Security benefits and increased Medicare costs could impact retirees’ budgets in the new year, according to an article by Yahoo Finance. What they’re saying: “Because more… The Biggest Retirement Changes Coming In 2024

A new report from Morningstar suggests that the “4 percent” rule may be a safe option for retirees once again as investment portfolios recover from last year’s losses. more… Morningstar: 4 Percent Rule May Be Safe Again

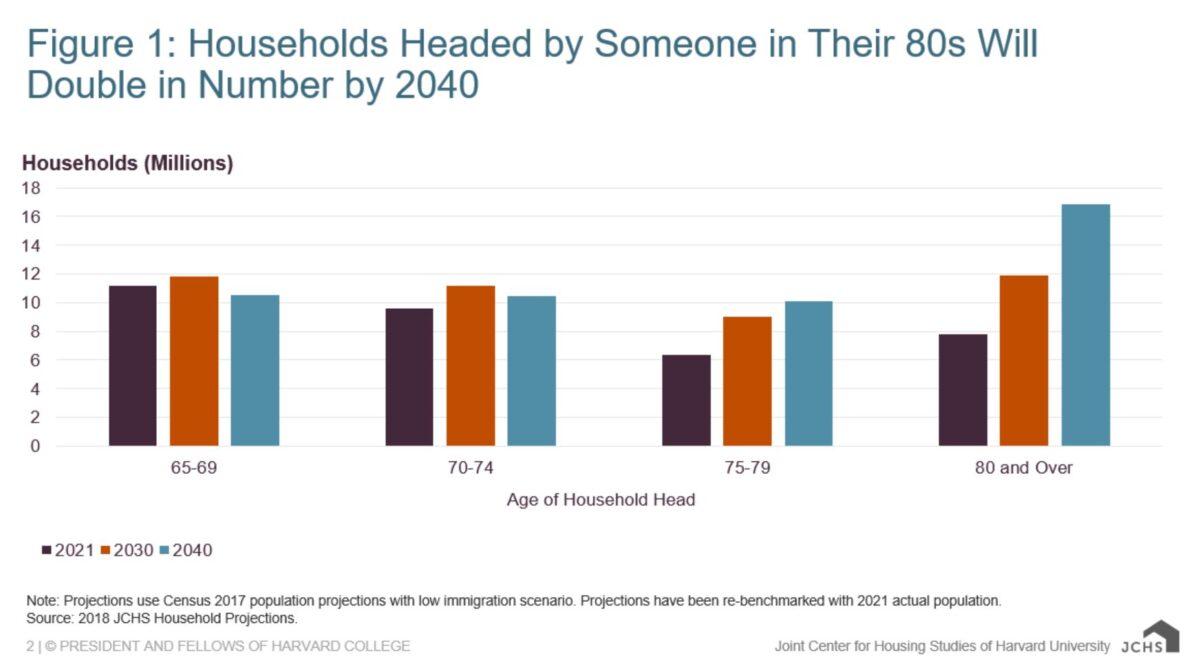

The number of households headed by a person aged 80 and over will more than double to nearly 17 million between 2021 and 2040. However, the United States more… The Challenges Caring For An Aging Population

Jackson National Life Insurance Company, in partnership with the Center for Retirement Research at Boston College, published a study on how retirees and financial professionals perceive retirement risk more… Study: Retirement Investors Inaccurately Predict Life Expectancy

Transamerica surveyed its policyholders about their experiences with long-term care, their biggest concerns, and how and where they prefer to receive care, if needed. Why it matters: As more… Transamerica Report Underscores Importance of LTC Planning

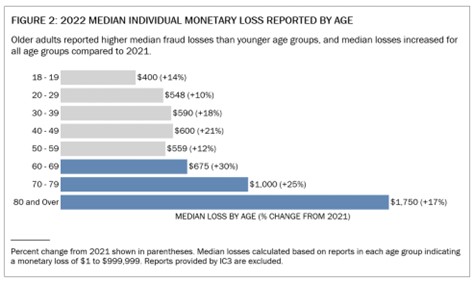

The Federal Trade Commission issued a report to Congress that found adults aged 60 and over lost $1.6 billion to fraud in 2022, but because the vast majority of more… FTC Issues Annual Report On Actions to Protect Older Adults

The Social Security Administration announced a 3.2 percent cost of living adjustment (COLA) for 2024, but a new survey conducted by The Senior Citizens League (TSCL) indicates that more… SSA Announces 3.2 Percent COLA For 2024

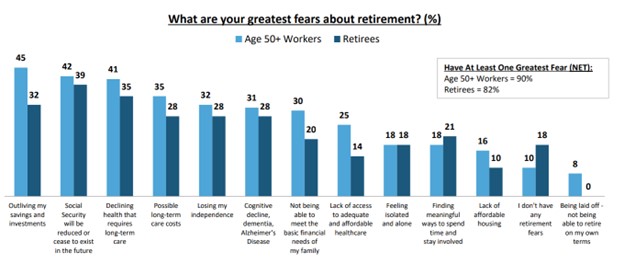

New research from the Transamerica Center for Retirement Research, titled Life in Retirement: Pre-Retiree Expectations and Retiree Realities, describes the retirement aspirations and insecurities of retirees and age more… Life in Retirement: Pre-Retiree Expectations and Retiree Realities

Living costs and inflation rates vary considerably around the country, which means a Social Security check or other retirement assets go farther in some regions than in others. more… True Cost of Growing Older in America

We all benefit from being able to go online. The internet keeps us entertained and connected, and during the times we can’t get out and socialise, it’s a more… Insights into digital banking