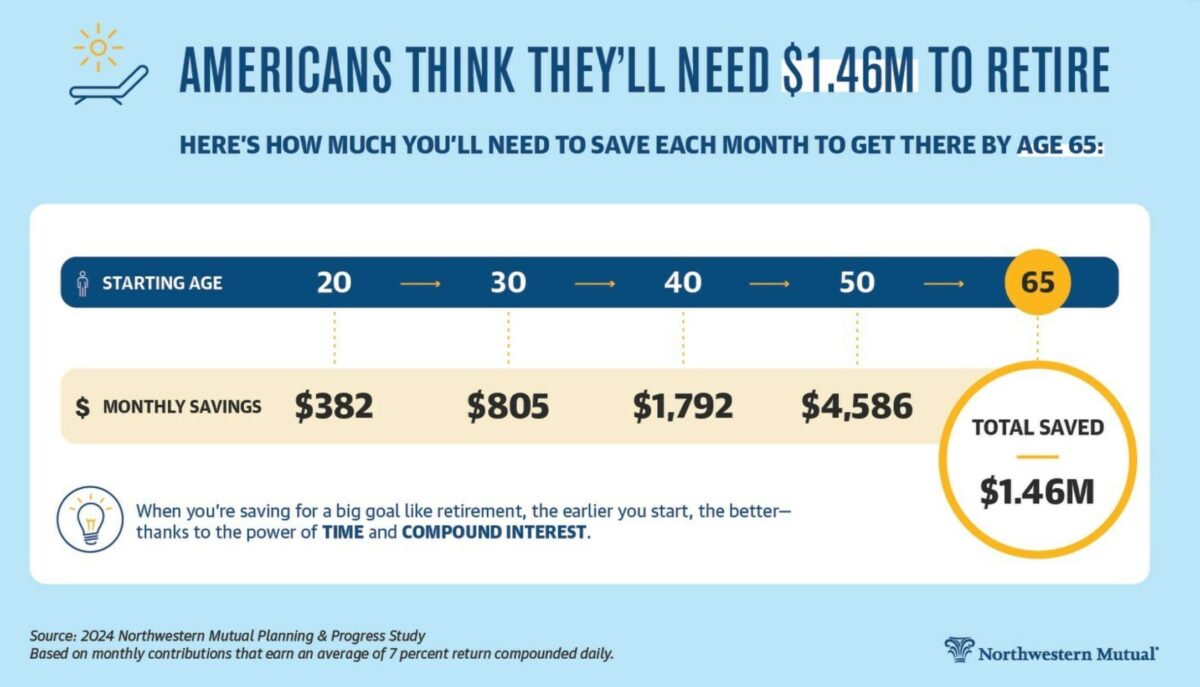

Vanguard released the 23rd edition of its “How America Saves” report, which spotlighted the retirement-saving behaviors of nearly five million Vanguard participants. Go deeper: The report found that employees are more… Highlights From “How America Saves 2024” Report

Highlights From “How America Saves 2024” Report