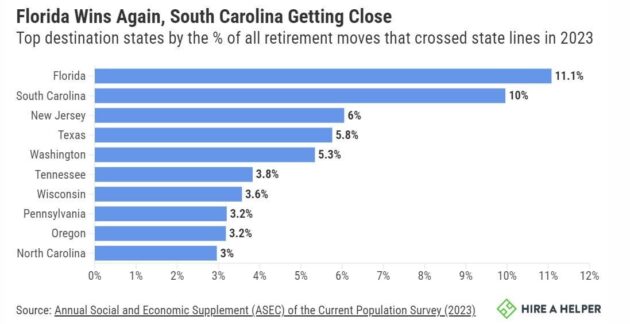

Bankrate’s annual Best and Worst States to Retire Study found that Delaware is the best state for retirees in 2024, followed by West Virginia (2), Georgia (3), South more… Best and Worst States to Retire in 2024

Best and Worst States to Retire in 2024